As i mentioned earlier most modern term life policies do not technically expire until age 95 regardless of the term period. Buying life insurance doesnt have to be a long and painful process we can make it quick and easy.

Annual Renewal Term Life Insurance Quotes Best Art Plans

Annual Renewal Term Life Insurance Quotes Best Art Plans

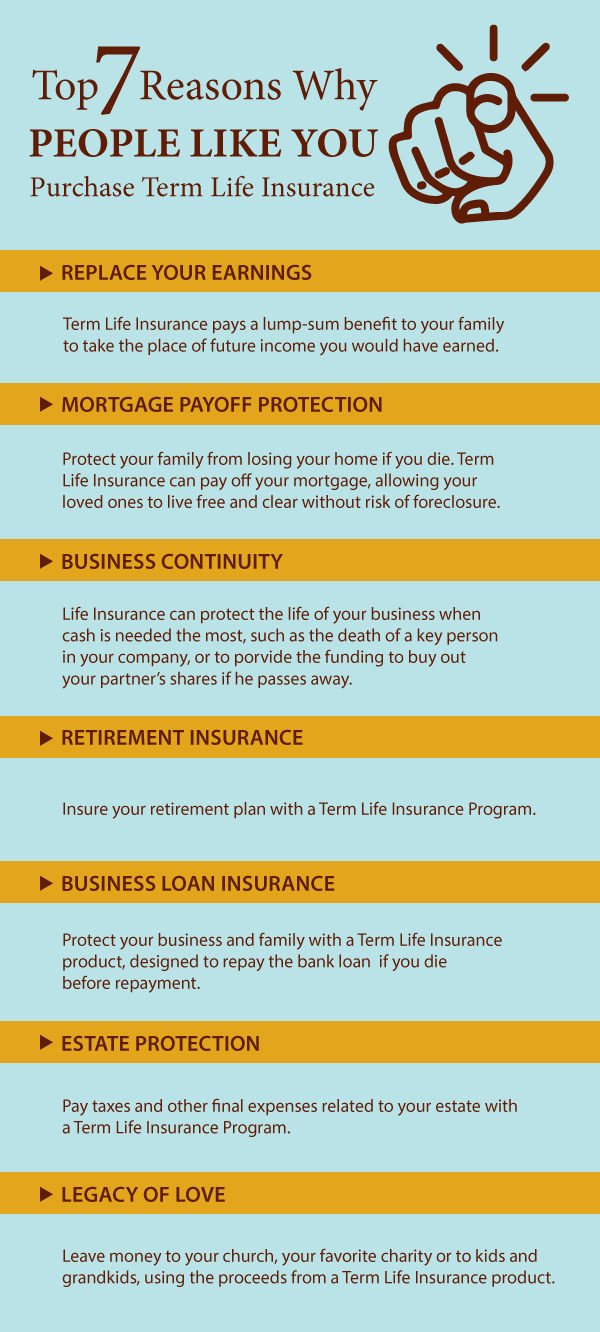

Once youve decided that you want term life insurance instead of whole life you have two more decisions to make.

Term life insurance how long. When does a term life insurance policy pay out and how long does it usually take. The duration of the financial obligations you. There are several different types of life insurance that you have to choose from but the most popular option is term life insurance.

Allen on facebook wants to know how to determine the length of term life insurance. Determining coverage amount is a combination of how much coverage you need for example to pay of a certain loan or to pay for a childs upbringing how much you can afford more coverage means higher. I f youre shopping for term life insurance two important considerations are how much coverage you need.

Theyre a brokerage firm so they shop among a gazillion different companies and get you the best price anywhere. You can buy term life insurance for term periods of 10 15 20 25 or 30 years. To effectively incorporate a term life insurance policy into your financial portfolio you must understand how and when term life insurance payouts are delivered to beneficiaries.

Types of term life insurance. How much coverage you need and how long you want your term to last. How much coverage to buy and how long the policy should last.

While many people folks on the amount of coverage. Term life insurance is a popular part of long term financial planning. Jeff zander is a friend of mine and ive endorsed that company for about a dozen years.

So the question that remains once youve gotten this far is how many years of term life insurance do i need. The term period simply locks in the policy cost for that specific time. As you might have guessed the answer isnt immediately obvious but by taking a look at a few different aspects of your life you should be able to find the right answer.

Can the term insurance. There are several kinds of term life insurance. Many term life policies give you the option to renew your coverage at the end of the term without undergoing another medical exam.

And how long your term should be. I buy my term life insurance from zander insurance. I just read a recent article about life insurance in your 20s and i would have a couple of questionshow long can term insurance terms be.

Level premium for the policys time period say 20 years your premium stays the same. Because life insurance is such a vital purchase you want to ensure that youre making the best decision for you and your family. When youre buying term life insurance you have two main decisions.

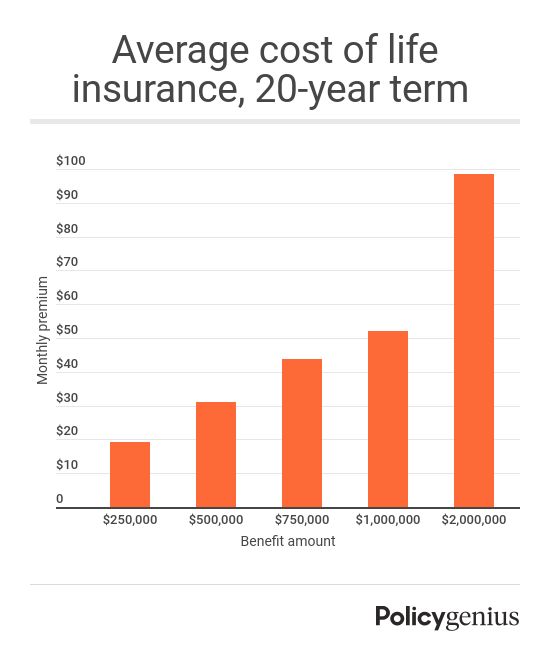

The Cost Of Life Insurance Policygenius

The Cost Of Life Insurance Policygenius

Term Life Insurance Term Life Insurance How Long Should The Term Be

Term Life Insurance Term Life Insurance How Long Should The Term Be

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

Short Term Life Insurance Know Your Options

Short Term Life Insurance Know Your Options

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

Here S What Alex Trebek Won T Tell You About Colonial Penn 9 95 Rates

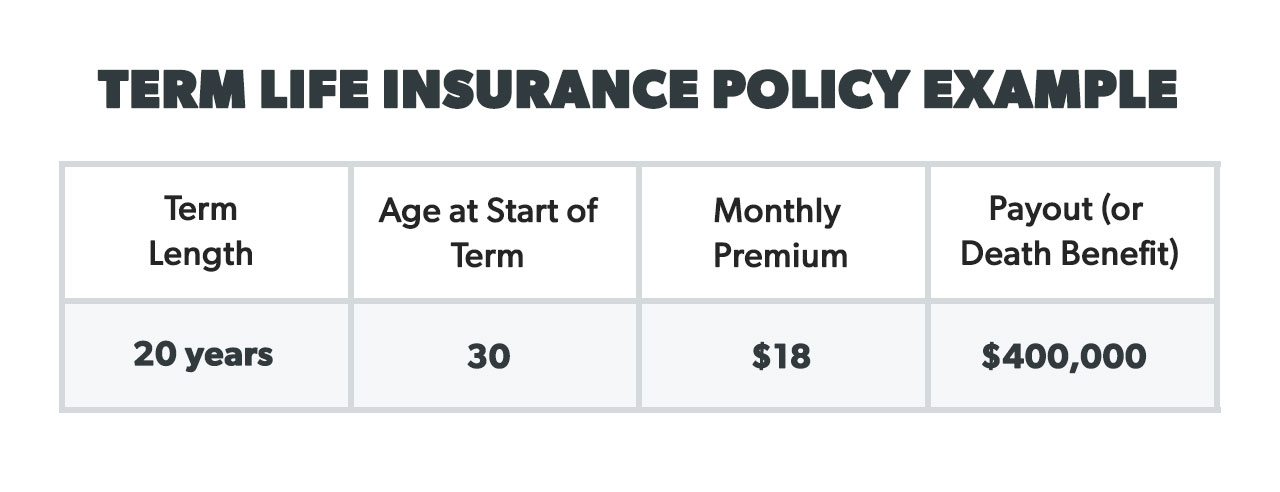

What Is Term Life Insurance And How It Works The Smart Investor

What Is Term Life Insurance And How It Works The Smart Investor

The Differences Between Term And Whole Life Insurance

The Differences Between Term And Whole Life Insurance

What Does Term Life Insurance Cost Sample Rates By Age 2020

What Does Term Life Insurance Cost Sample Rates By Age 2020

Should You Get A Term Life Insurance Plan We Explain How It Works

Should You Get A Term Life Insurance Plan We Explain How It Works

How To Select The Best Term Life Insurance Plan For You

How To Select The Best Term Life Insurance Plan For You

Get Here First To Die Term Life Insurance Quotes Squidhomebiz

Get Here First To Die Term Life Insurance Quotes Squidhomebiz

What Is Universal Life Insurance Daveramsey Com

What Is Universal Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

What Is Term Life Insurance Daveramsey Com

Online Term Life Insurance Pages 1 1 Text Version Fliphtml5

Online Term Life Insurance Pages 1 1 Text Version Fliphtml5

Why Combine Long Term Care And Life Insurancefhk Insurance

Why Combine Long Term Care And Life Insurancefhk Insurance

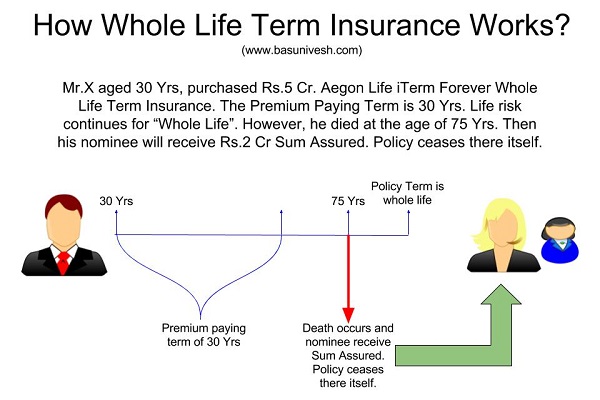

Aegon Life Iterm Forever Whole Life Term Insurance Should You

Aegon Life Iterm Forever Whole Life Term Insurance Should You

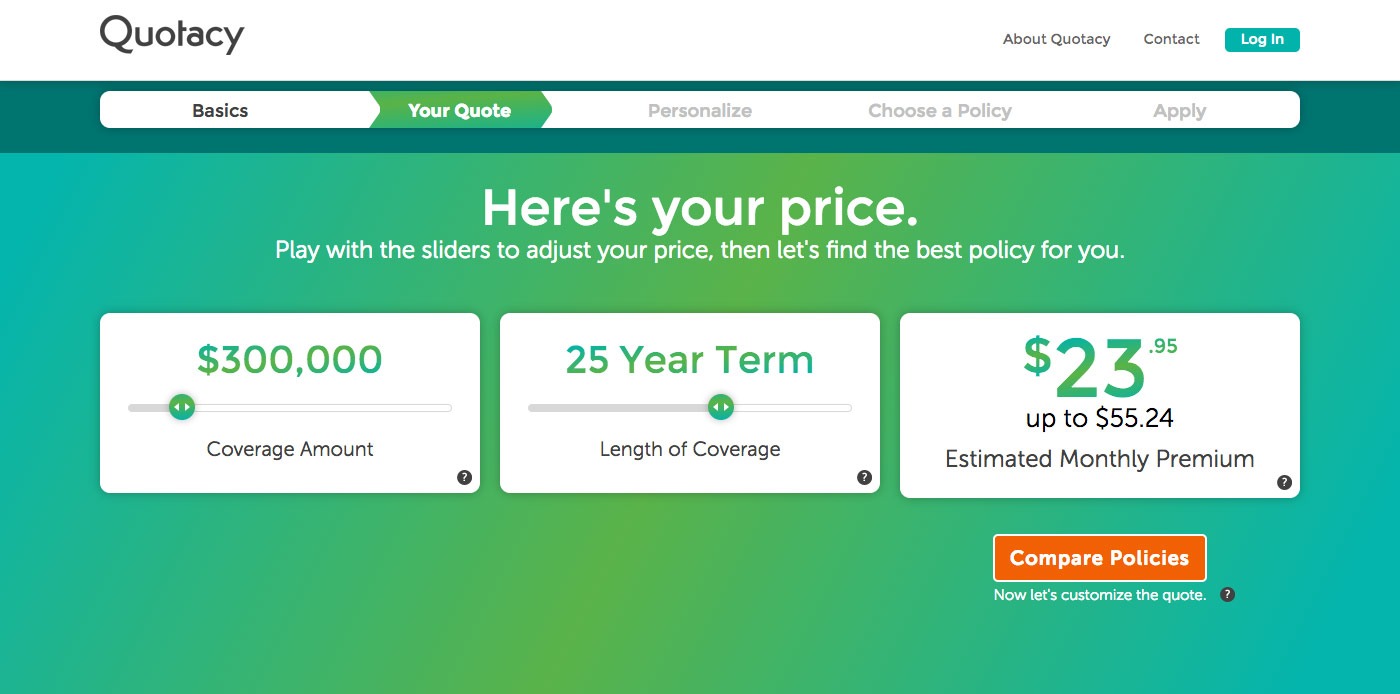

How Long Should Term Insurance Last Quotacy

How Long Should Term Insurance Last Quotacy

Whole V Term Term Length Presentation 1

Whole V Term Term Length Presentation 1

Best Term Life Insurance For Seniors Rates Secrets Revealed Buy

Best Term Life Insurance For Seniors Rates Secrets Revealed Buy

Komentar

Posting Komentar