Survivorship life insurance definition if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options. This is different from first to die joint life insurance policies which pay out after one of the policyholders dies.

Survivorship Life Insurance For Wealth Transfer Estate

Survivorship Life Insurance For Wealth Transfer Estate

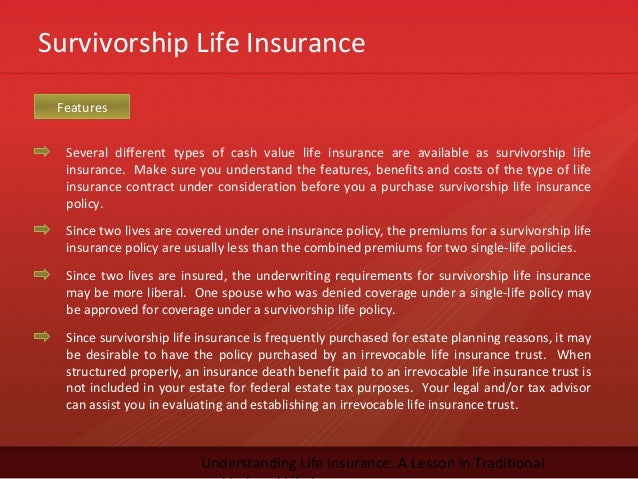

Since it covers two people the policy will most likely last longer due to the lower probability of two people dying early as opposed to just one.

Survivorship life insurance definition. Survivorship life insurance policies are also known as second to die policies which gives you the answer to when these kinds of policies pay out. Survivorship life insurance definition and how it works. What is survivorship life insurance.

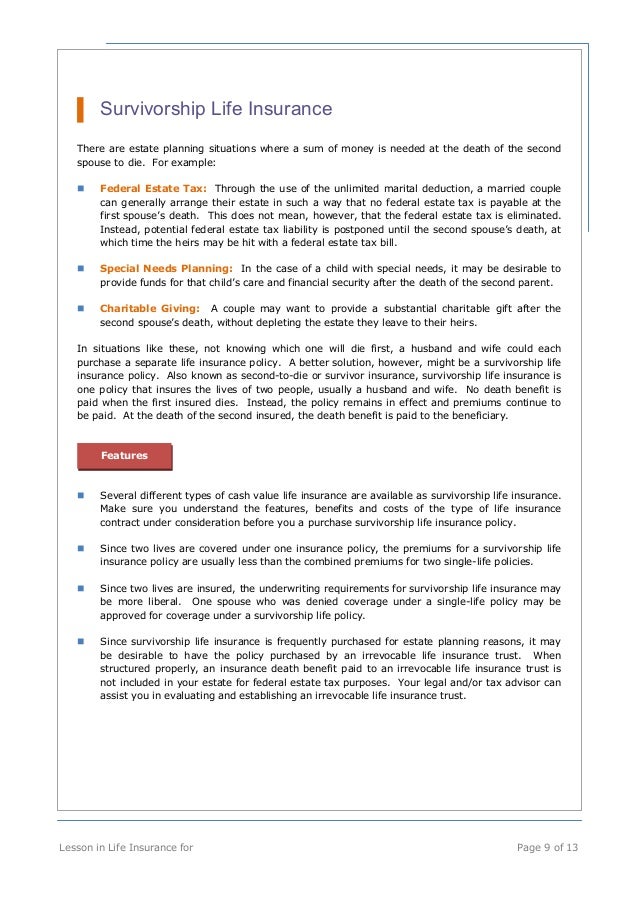

It makes sense in some situations. Variable survivorship life insurance is a type of variable life insurance policy that covers two individuals and pays a death benefit to a beneficiary only after both people have died. The proceeds of the policy are paid when the second of the insured persons dies.

Survivorship life insurance also known as joint survivor life insurance or second to die life insurance insures two lives and pays the death benefit upon the. Also called dual life insurance or second to die insurance. Lets dive in and take a look.

After all life insurance isnt a one size fits all product and you need to be able to select the right coverage based on your individual needs. It does not. Not everyone needs second to die life insurance but it can be very beneficial in certain situations.

A survivorship life insurance policy is designed to insure two lives under one policy with one premium payment. Once both policyholders die the death benefit is paid. Survivorship life insurance definition.

A form of insurance which pays a death benefit only upon the death of the last surviving insured person. Survivorship life insurance is usually less expensive than permanent life insurance for just one person. Survivorship life insurance also known as second to die life insurance covers multiple people and is often purchased by spouses.

It is also called survivorship life insurance or dual life insurance. Because the second spouse does not owe the estate tax upon the death of the first spouse second to die insurance helps the heirs of the married couple rather than either the husband or the wife. When it comes to life insurance you have many choices and with good reason.

This type of life insurance also known as second to die life insurance is designed to cover the lives of two persons. Often used by a married couple in estate planning.

Survivorship Life Insurance For Wealth Transfer Estate

Survivorship Life Insurance For Wealth Transfer Estate

Form Of Individual And Survivorship Life Insurance Application

Form Of Individual And Survivorship Life Insurance Application

Best Life Insurance Companies The Top 12 Best In America

Best Life Insurance Companies The Top 12 Best In America

Form Of Individual And Survivorship Life Insurance Application

Form Of Individual And Survivorship Life Insurance Application

Help Them Guarantee A Legacy With Optionality Wbassoc Pages 1

Help Them Guarantee A Legacy With Optionality Wbassoc Pages 1

Analysis Of Survivorship Life Insurance Portfolios With Stochastic

Analysis Of Survivorship Life Insurance Portfolios With Stochastic

The Advantages Of Survivorship Life Insurance Policies

The Advantages Of Survivorship Life Insurance Policies

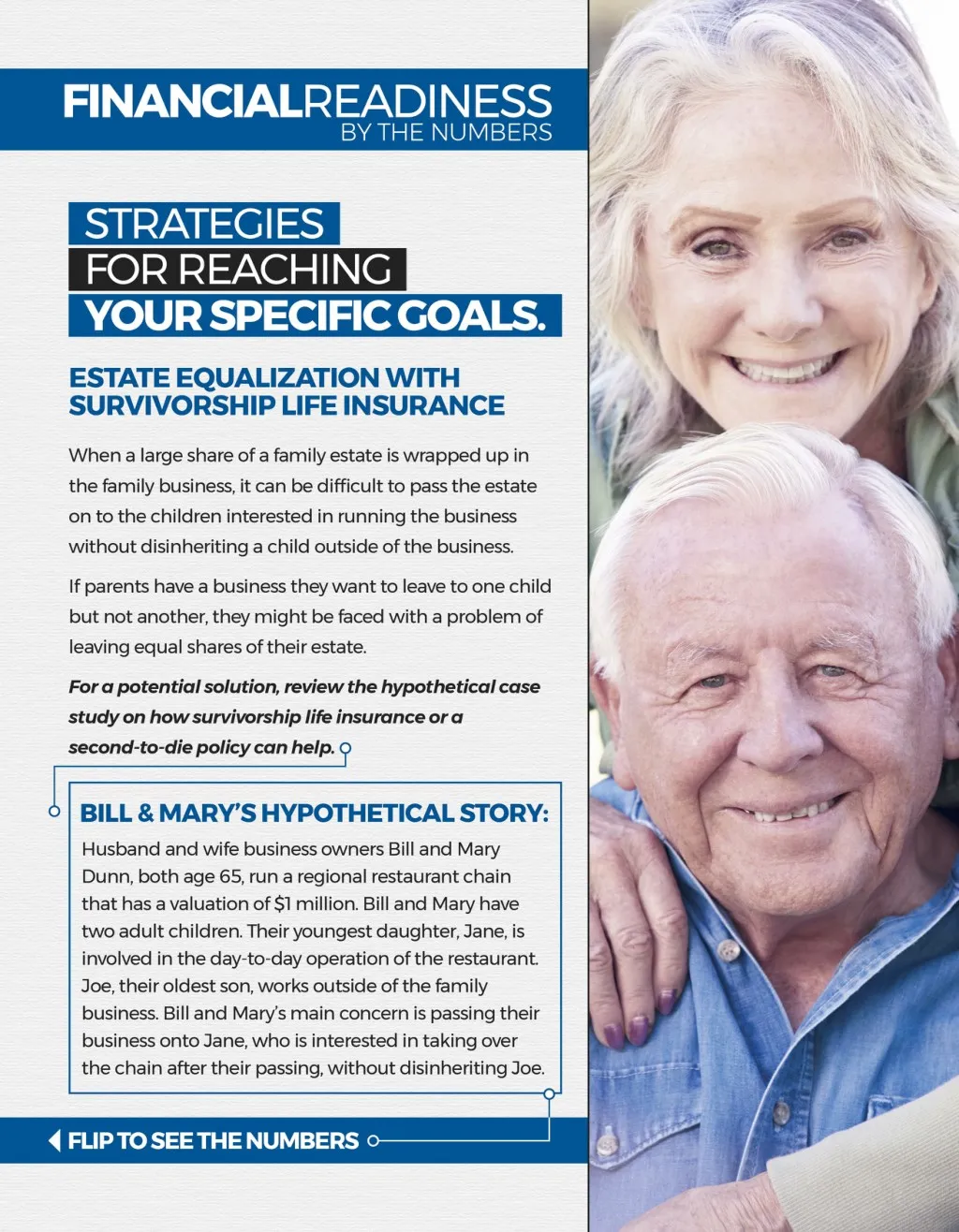

Ppt Pbc Insurance Group Estate Equalization With Survivorship

Ppt Pbc Insurance Group Estate Equalization With Survivorship

Term Life Insurance Why Some People Almost Always Save Money

Term Life Insurance Why Some People Almost Always Save Money

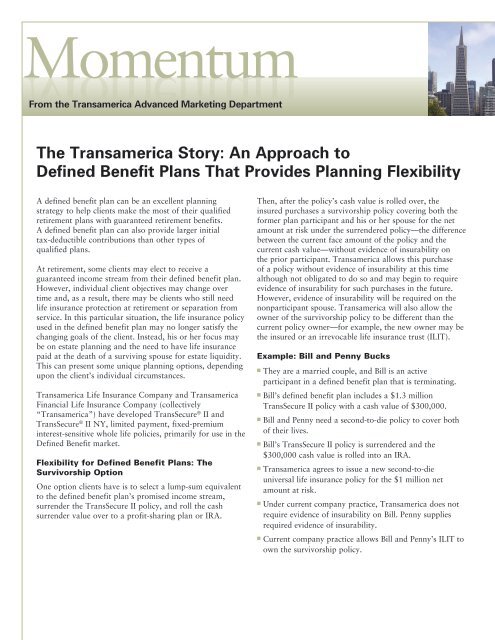

Defined Benefit Planning Flexibility Momentum Transamerica

Defined Benefit Planning Flexibility Momentum Transamerica

Survivorship Life Insurance For Wealth Transfer Estate

Survivorship Life Insurance For Wealth Transfer Estate

Why Use First To Die Life Insurance Finance Zacks

Why Use First To Die Life Insurance Finance Zacks

What Is Term Life Insurance Accuquote

What Is Term Life Insurance Accuquote

Life Insurance Terms Pdf Free Download

Life Insurance Terms Pdf Free Download

Life Insurance Policy Termination And Survivorship Sciencedirect

Life Insurance Policy Termination And Survivorship Sciencedirect

Survivorship Life Insurance Definition Advantages Disadvantages

Survivorship Life Insurance Definition Advantages Disadvantages

Types Of Life Insurance Which Is Right For You Daveramsey Com

Types Of Life Insurance Which Is Right For You Daveramsey Com

Ppt Life Insurance 101 Powerpoint Presentation Free Download

Ppt Life Insurance 101 Powerpoint Presentation Free Download

Life Insurance In The Estate Plan And Incapacity Planning Ppt

Life Insurance In The Estate Plan And Incapacity Planning Ppt

/insurance-9d68dd8aa5854570a057a2d759555438.jpg)

Komentar

Posting Komentar