We have no children. It must have a significant amount of cash value built up and a decent face amount to be marketable.

Shocking Lincoln Heritage Funeral Advantage Life Insurance Review

Shocking Lincoln Heritage Funeral Advantage Life Insurance Review

You may have heard that selling a life insurance policy is a good way to get cash for your retirement medical bills or long term care expenses.

Selling whole life insurance policy. But if youre unable to pay the premiums or no longer need life insurance selling your policy is an. There are two types of companies that purchase whole life insurance policies. Selling whole life insurance if you are looking for the best deals on insurance then our insurance quotes service can provide you with a wide range of options.

However you can cash out or borrow against the savings component of your policy and this is tax free if done after the first 15 years of the policy. Selling a life insurance policy is called a life settlement formerly known as and mostly synonymous with a viatical settlement. The process of selling your whole life insurance policy to a group of investors is called a life settlement.

Many people who own insurance policies they no longer want or need arent aware that they have more lucrative options than taking the cash value of the policy or letting it lapse. It may seem like a relatively easy way to get the cash you need quickly but this is not always the case. Her cash surrender value with paid up additions is around 200000.

The first is a life settlement company and the second is a viatical company. Final notes on selling whole life insurance. If you are looking to sell your whole life insurance it will likely be harder than selling term life insurance.

My question is about whole life insurancemy wife and i both have policies. If you meet the criteria for a life settlement its important to know that a life settlement amount typically exceeds the cash value of the policy. My policy is about 190000.

Very few policy owners know that there are ways to potentially get more than the cash value of a whole life insurance policy. Selling the policy means you wont have life insurance coverage and your beneficiaries will no longer receive the death benefit when you die but a quick cash influx can bring you a bit of comfort in old age. A whole life insurance policy has two parts.

Buying a permanent life insurance policy is a long term financial commitment. Universal life insurance and whole life insurance have a cash value component that allows the policy owner to surrender the policy and receive some money. In most cases yes you can sell a whole life insurance policy.

The truth is that selling a life insurance policy might be a viable alternative in some specific situations and even then it is a complex. This page covers the specifics on selling an existing whole life policy answers common questions and provides key details policy owners need to know before they borrow against the cash value.

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Policy Loans Tax Rules And Risks

Search Q Term Life Insurance Definition Tbm Isch

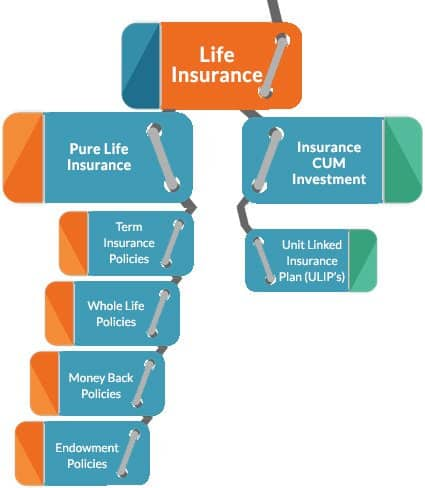

Life Insurance Online Life Insurance Plans Polices In India

Life Insurance Online Life Insurance Plans Polices In India

Is Life Insurance An Asset Why It May Be The Most Important Asset

Is Life Insurance An Asset Why It May Be The Most Important Asset

/GettyImages-499760171-5893b7c33df78caebcf8bcde.jpg) How Much Commission Does A Life Insurance Agent Earn

How Much Commission Does A Life Insurance Agent Earn

Is Life Insurance For Children A Waste Of Money

Is Life Insurance For Children A Waste Of Money

Life Insurance Insurance From Aig In The Us

Life Insurance Insurance From Aig In The Us

Report The Future Of Life Insurance Business Insider

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg) Whole Life Insurance Definition

Whole Life Insurance Definition

Can I Sell My Whole Life Insurance Policy Senior Resources

Can I Sell My Whole Life Insurance Policy Senior Resources

Shocking Lincoln Heritage Funeral Advantage Life Insurance Review

Shocking Lincoln Heritage Funeral Advantage Life Insurance Review

2020 Primerica Life Insurance Review Reasons To Be Wary Of

2020 Primerica Life Insurance Review Reasons To Be Wary Of

Whole Life Insurance How It Works

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

/32863956976_0e10da5786_o-457a3aa72d3041288ac916eada5ea83a.jpg) Best Ways To Find Life Insurance Leads

Best Ways To Find Life Insurance Leads

How Is Life Insurance Sold Iii

How Is Life Insurance Sold Iii

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

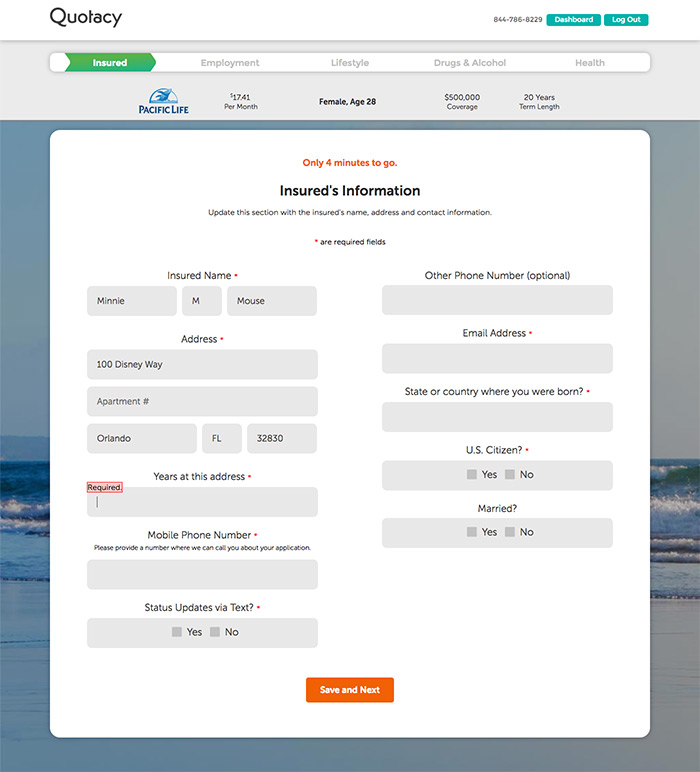

Can I Buy Life Insurance On Someone Else Quotacy

Can I Buy Life Insurance On Someone Else Quotacy

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

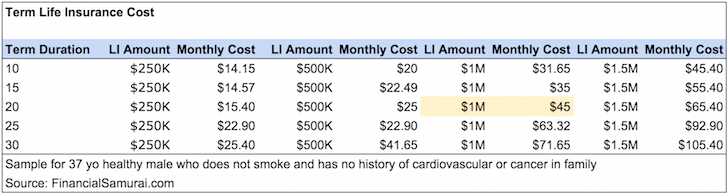

How Much Life Insurance Do I Need Financial Samurai

How Much Life Insurance Do I Need Financial Samurai

How Much Commissions Do Insurance Agents Earn

How Much Commissions Do Insurance Agents Earn

Life Insurance Online Discover Best Life Cover Plans Policy In

Life Insurance Online Discover Best Life Cover Plans Policy In

Komentar

Posting Komentar