Renewable and convertible term life insurance policies have features that allow you to do the following. Most financial advisors will recommend getting a policy that is renewable.

Renewable term refers to a clause in many term life insurance policies that allow for its renewal without he need for new underwriting.

Renewable and convertible term life insurance. This means that you can renew your policy to last beyond the term period that you purchased. This product features an optional waiver of premium rider that will allow. Convertible vs renewable term life insurance.

Lets not beat around the bush this question is nearly impossible for us to answer because we would have to give a different answer to every single person reading this guide to the best convertible affordable life insurance. Protecting your family in the event of your death doesnt have to break your budget. Whilst term life insurance policies normally stop providing cover at the end of the term once the plan runs out there are options to continue the coverage.

Are you worried what would happen if you were to suddenly become disabled. Renewable term life insurance. Term life insurance plans are designed to provide a death settlement to individuals who die within a specific time period.

What it means and how it works. The majority of term life policies are indeed renewable. Should you need to extend your coverage for a further five years the premium will be adjusted according to your age at the date of renewal.

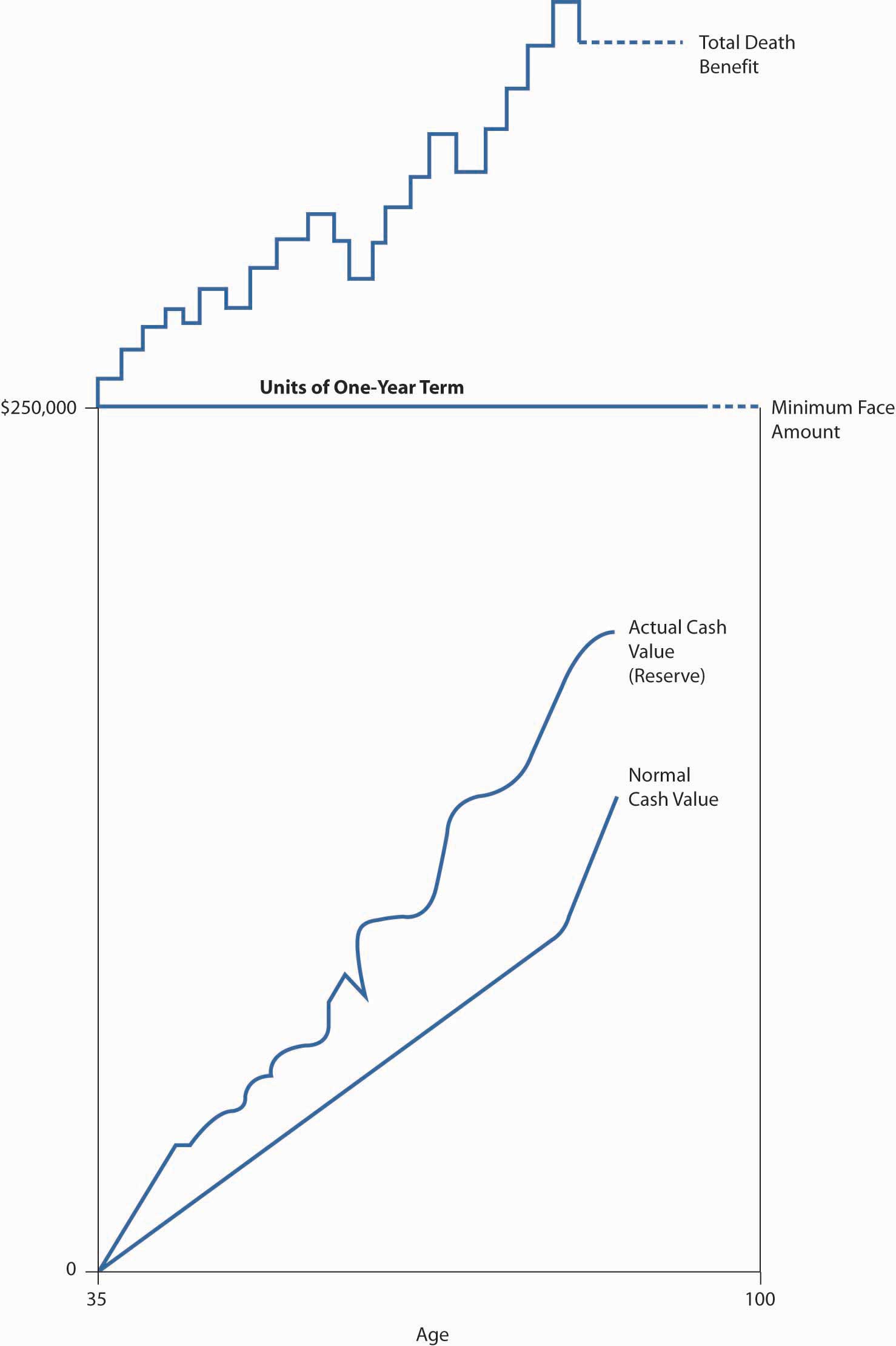

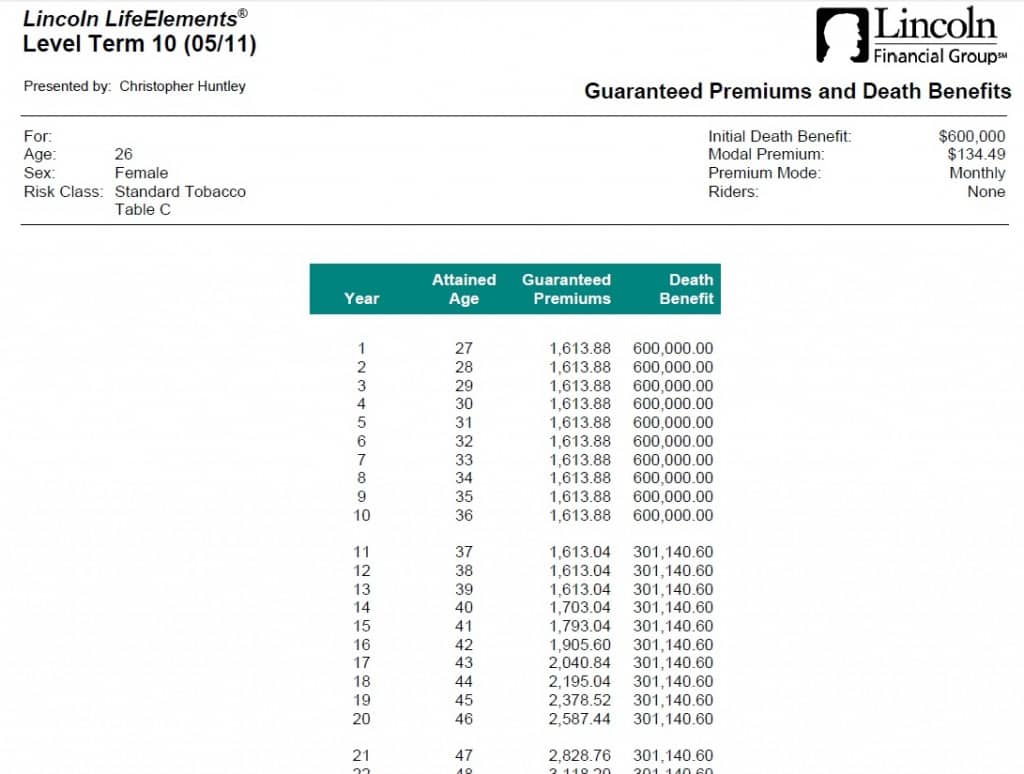

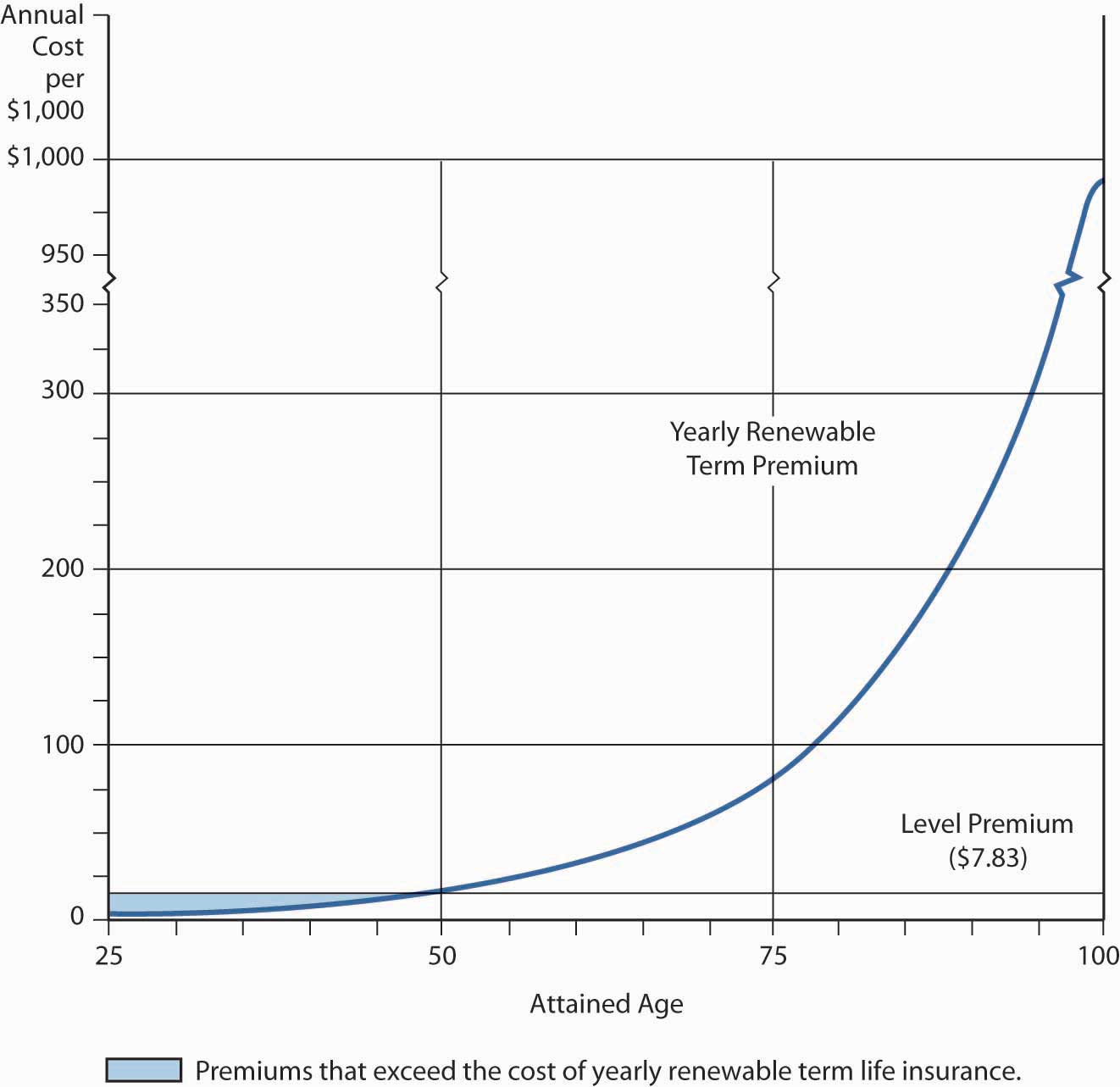

Eg a 10 year term policy may be renewable to age 80 with the premium going up each year after the original 10 year period ends. Policies can be just renewable just convertible or both renewable and convertible. Renewable and convertible term life insurance rc a form of term life insurance that is usually issued for a period of 1 or 5 years that can be renewed for additional terms or can be converted to a permanent or cash value policy.

5 year renewable and convertible term insurance gives maximum insurance protection for your premium dollar. We offer a renewable and convertible term life insurance policy that is customizable and affordable to meet your needs in any stage of life. In this lesson well explore how convertible and renewable features included with some term life insurance policies offer risk management solutions for people who may be worried about their.

Renewable and convertible life insurance policies are both types of term life insurancerenewing a policy increases your coverage for another term while converting it will turn it into a whole life insurance policy. Unlike whole life insurance term life insurance allows you to determine your current needs and seek coverage accordingly. With renewable term coverage can be extended even if the.

For more details on the definition of term life insurance plans please click the previous link.

Best Life Insurance For Seniors For 2020 The Simple Dollar

Best Life Insurance For Seniors For 2020 The Simple Dollar

Term Life Insurance Quotes Online Rates Policy Types Western

Term Life Insurance Quotes Online Rates Policy Types Western

Term Insurance Riders Administration Rules And Guidelines Document

Term Insurance Riders Administration Rules And Guidelines Document

How To Convert Your Term Insurance To Whole Life Insurance Youtube

How To Convert Your Term Insurance To Whole Life Insurance Youtube

What Is Renewable Term Life Insurance

What Is Renewable Term Life Insurance

And Minus Points Of Term Life Insurance When Should You Buy It

And Minus Points Of Term Life Insurance When Should You Buy It

Pruterm 15 Term Insurance Pru Life Uk

Pruterm 15 Term Insurance Pru Life Uk

Life Insurance Market Conditions And Life Insurance Products

Life Insurance Market Conditions And Life Insurance Products

2020 Best Term Life Insurance Companies And Rates

2020 Best Term Life Insurance Companies And Rates

Compare Term Vs Whole Life Insurance Policy

Compare Term Vs Whole Life Insurance Policy

Term Life Insurance Benefits For You And Your Family

Term Life Insurance Benefits For You And Your Family

/79334210-F-56a7032b5f9b58b7d0e60516.jpg) Choosing Term Life Insurance For A Low Cost Policy

Choosing Term Life Insurance For A Low Cost Policy

Term Life Insurance Definition

Term Life Insurance Definition

How Does Term Life Insurance Work Difinitive Guide 2020

How Does Term Life Insurance Work Difinitive Guide 2020

Convertible Term Life Insurance

Convertible Term Life Insurance

Is Your Term Life Policy Expiring Here S 5 Ways To Save It

Is Your Term Life Policy Expiring Here S 5 Ways To Save It

Ch 7 Planning Ahead Ch 7 Planning Ahead 7 1 Life Insurance Who

Ch 7 Planning Ahead Ch 7 Planning Ahead 7 1 Life Insurance Who

Mortality Risk Management Individual Life Insurance And Group

Mortality Risk Management Individual Life Insurance And Group

Https S3 Us West 2 Amazonaws Com Lifebenefits What Is The Best Kind Of Life Insurance Pdf

2020 Guide To Term Life Vs Whole Life Insurance Definition Pros

2020 Guide To Term Life Vs Whole Life Insurance Definition Pros

Komentar

Posting Komentar